Introduction

Dollar cost averaging is a popular investment strategy that has been widely used in traditional investment markets such as stocks, bonds, and mutual funds. The same principle can be applied to the cryptocurrency market. This strategy involves investing a fixed amount of money into a particular asset at regular intervals over an extended period of time, instead of investing a lump sum all at once.

The purpose of dollar cost averaging is to minimize the impact of market volatility on the investment. When investing in a volatile market such as the cryptocurrency market, the value of the asset can fluctuate greatly in a short period of time. By investing a fixed amount at regular intervals, the investor can take advantage of the market’s downward trend and purchase more units at a lower price, which can lead to a lower average cost per unit over time.

Introduction

Introduction

Dollar cost averaging is a popular investment strategy that has been widely used in traditional investment markets such as stocks, bonds, and mutual funds. The same principle can be applied to the cryptocurrency market. This strategy involves investing a fixed amount of money into a particular asset at regular intervals over an extended period of time, instead of investing a lump sum all at once.

The purpose of dollar cost averaging is to minimize the impact of market volatility on the investment. When investing in a volatile market such as the cryptocurrency market, the value of the asset can fluctuate greatly in a short period of time. By investing a fixed amount at regular intervals, the investor can take advantage of the market’s downward trend and purchase more units at a lower price, which can lead to a lower average cost per unit over time.

Introduction

Dollar cost averaging is a popular investment strategy that has been widely used in traditional investment markets such as stocks, bonds, and mutual funds. The same principle can be applied to the cryptocurrency market. This strategy involves investing a fixed amount of money into a particular asset at regular intervals over an extended period of time, instead of investing a lump sum all at once.

The purpose of dollar cost averaging is to minimize the impact of market volatility on the investment. When investing in a volatile market such as the cryptocurrency market, the value of the asset can fluctuate greatly in a short period of time. By investing a fixed amount at regular intervals, the investor can take advantage of the market’s downward trend and purchase more units at a lower price, which can lead to a lower average cost per unit over time.

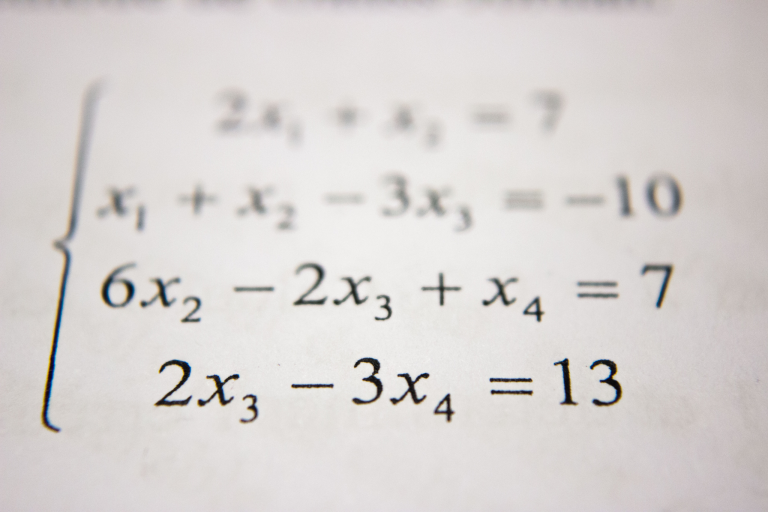

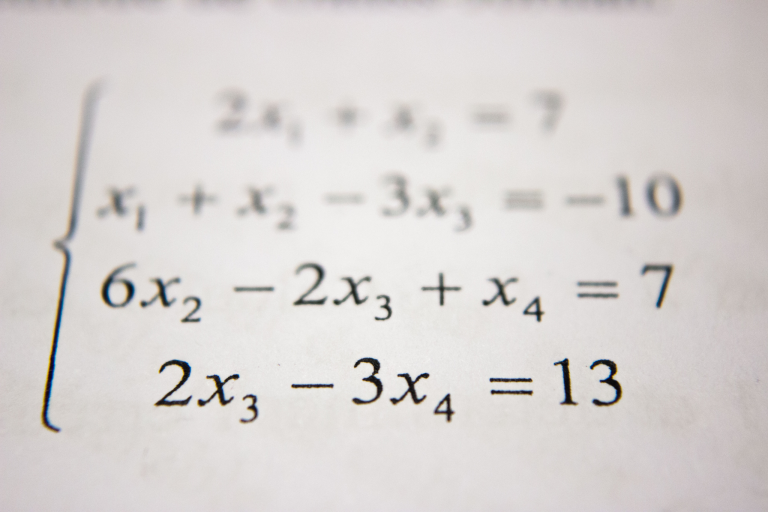

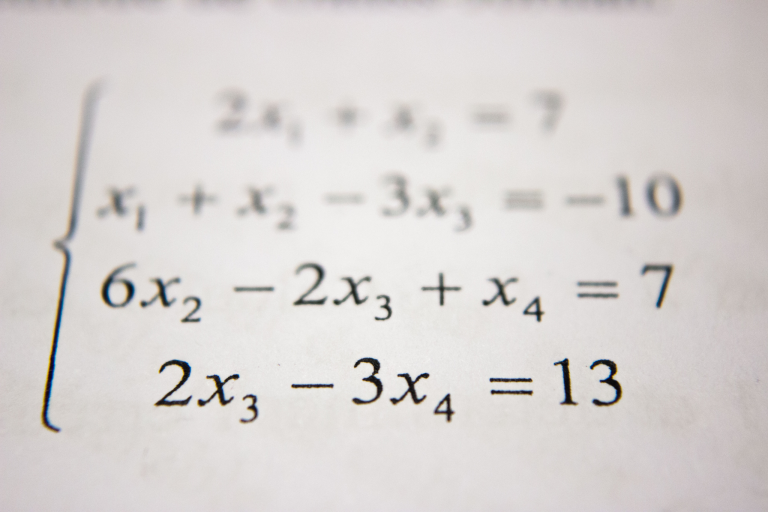

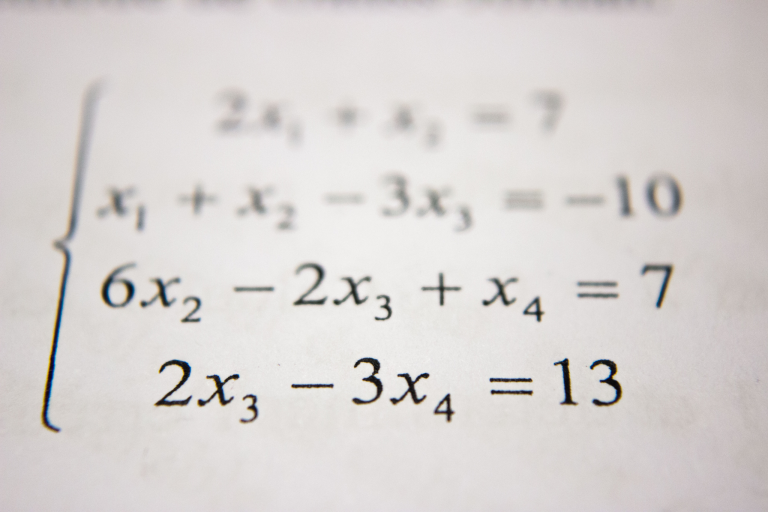

Dollar Cost Averaging Example

To better understand the concept of dollar cost averaging in the cryptocurrency market, let’s take a look at a simple calculation example.

Suppose an investor wants to invest $1000 into Bitcoin over a 12-month period. Instead of investing the entire $1000 all at once, the investor decides to invest $83.33 each month.

In the first month, the price of Bitcoin is $5000, and the investor purchases 0.0167 Bitcoins for $83.33. In the second month, the price of Bitcoin has increased to $7000, and the investor purchases 0.0119 Bitcoins for $83.33. In the third month, the price of Bitcoin has decreased to $3000, and the investor purchases 0.0277 Bitcoins for $83.33.

By the end of the 12-month period, the investor has invested a total of $1000, which has purchased 0.1029 Bitcoins. The average cost per Bitcoin is calculated as $1000 divided by 0.1029, which equals $9,739.25.

As we can see from this example, the investor has benefited from the market’s fluctuations by purchasing more Bitcoins at a lower price during the downward trend. If the investor had invested the entire $1000 all at once, the average cost per Bitcoin would have been $5000, which is significantly higher than the average cost per Bitcoin using the dollar cost averaging strategy.

Not Perfect...

It’s worth noting that this strategy may not always result in a lower average cost per unit. If the market continues to rise, the investor may end up with a higher average cost per unit than if they had invested a lump sum all at once. However, the purpose of dollar cost averaging is not to guarantee a profit but rather to minimize the impact of market volatility on the investment.

Dollar cost averaging can also be applied to other cryptocurrencies such as Ethereum, Litecoin, Ripple, and so on. The same principle and calculation method can be used. The only difference is the price of the specific cryptocurrency and the number of units purchased with the fixed investment amount.

Not Perfect...

It’s worth noting that this strategy may not always result in a lower average cost per unit. If the market continues to rise, the investor may end up with a higher average cost per unit than if they had invested a lump sum all at once. However, the purpose of dollar cost averaging is not to guarantee a profit but rather to minimize the impact of market volatility on the investment.

Dollar cost averaging can also be applied to other cryptocurrencies such as Ethereum, Litecoin, Ripple, and so on. The same principle and calculation method can be used. The only difference is the price of the specific cryptocurrency and the number of units purchased with the fixed investment amount.

Conclusion

In conclusion, dollar cost averaging is a proven investment strategy that can be applied to the cryptocurrency market. By investing a fixed amount of money into a particular cryptocurrency at regular intervals over an extended period of time, the investor can take advantage of the market’s fluctuations and minimize the impact of market volatility on the investment. This strategy may not guarantee a profit, but it can help reduce the risk associated with investing in a volatile market such as the cryptocurrency market.